Probably, many have been asking this question, “How long does life insurance take to pay out?” well, worry not because this article will clearly give you all the details you require to know.

Life insurance payouts typically occur within 30 to 60 days after submitting a claim. However, the timeframe can vary depending on policy terms, cause of death, and how quickly the claim is filed.

Please refrain from filing or providing required documents, which may prolong the process. If there are suspicions of fraud, the insurance company may conduct an investigation, further delaying the payout.

While there’s no strict deadline for filing a claim, certain conditions must be met, including the beneficiary(ies) filing the claim and the active policy at the time of the insured’s death.

The insurance company reviews the claim to verify the policyholder’s passing before releasing funds. This review typically takes up to 30 days, but timelines can vary by state.

Typical Payout for Life Insurance

Life insurance payouts vary widely, typically ranging from $250,000 to $1,000,000.

Smaller term life policies may offer around $50,000, while larger whole life policies can go up to several million dollars.

Term life policies generally have lower payouts compared to whole life or universal life policies.

The payout process usually takes between 30 and 60 days, but in straightforward cases, it can be as quick as two weeks. Delays may occur if the insurance company needs to investigate the death.

On average, life insurance payouts in the U.S. amount to about $168,000.

Life Insurance Pay Out InfographPayout Potentials: What Shapes Your Insurance Returns

- Policy Type: Different types of policies offer varying payout amounts. For instance, term life policies generally have lower payouts compared to whole life or universal life policies.

- Premium Amount: The amount you pay in premiums often influences the payout you receive. Generally, higher premiums mean larger payouts.

- Age and Health: Younger and healthier individuals typically qualify for higher coverage amounts at lower premium rates.

- Policy Enhancements: Adding extra features like accidental death or critical illness riders can boost the payout amount in certain situations.

Why Should you Understand how Payout works?

It’s crucial for policyholders to grasp how payouts function.

Financial Planning: Understanding payout terms allows policyholders to incorporate insurance benefits into their overall financial planning. They can better assess their coverage needs and ensure they have adequate protection for themselves and their loved ones.

Peace of Mind: Knowing the potential payout amount provides peace of mind, especially during uncertain times. It offers reassurance that there’s a safety net in place to support them or their beneficiaries financially in the event of an unexpected loss.

Claim Process Efficiency: Familiarity with the payout process streamlines the claims procedure. Policyholders can gather necessary documentation and fulfill requirements more efficiently, reducing delays in receiving the payout.

Policy Comparison: Understanding payout structures allows policyholders to compare different insurance policies effectively. They can evaluate not only premiums but also potential benefits to determine which policy offers the best value for their individual circumstances.

What’s the Typical Timeframe for Life Insurance Payouts?

Life insurance payouts generally occur within 30 to 60 days following the filing of a claim, but this timeframe hinges on various factors, as outlined below:

- Policy Terms: Certain policies may include clauses that could potentially stall the payout process. These clauses might entail specific conditions or requirements that need to be met before the insurer releases the funds. For example, some policies might stipulate a waiting period or require additional documentation.

- Cause of Death: The circumstances surrounding the insured individual’s death can significantly impact the payout timeline. Deaths that necessitate further investigation, such as those resulting from accidents or with unclear causes, may lead to delays as the insurance company assesses the situation and ensures that all policy terms are met.

- Claim Submission Timeliness: The promptness with which the claim is filed and the necessary documents are submitted play a crucial role in expediting the payout process. Delays in either of these aspects can prolong the timeframe for receiving the insurance proceeds. Therefore, it’s essential for beneficiaries to promptly initiate the claims process and provide all required documentation to the insurer.

- Insurance Company Procedures: Each insurance company has its own set of procedures and protocols for processing claims. These procedures can vary in complexity and efficiency, influencing the overall duration of the payout process. Factors such as the volume of claims, internal review processes, and communication channels can all impact how quickly the insurer processes and approves a claim.

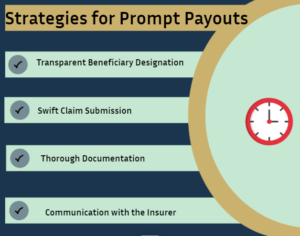

Strategies for Prompt Payouts

1. Swift Claim Submission

It’s crucial to initiate the claims process promptly following the insured individual’s passing.

The sooner the claim is filed, the quicker the insurance company can begin processing it, potentially expediting the payout timeline.

2. Thorough Documentation

Provide all necessary documentation in a timely and accurate manner. This includes essential paperwork such as the death certificate and relevant policy documents.

Ensuring completeness and accuracy in the documentation can help prevent unnecessary delays in the claims review process.

3. Transparent Beneficiary Designation

Clearly designate beneficiaries in the policy documentation to avoid complications during the claims process.

Ambiguities or discrepancies in beneficiary designation can lead to delays or disputes, hindering the timely distribution of insurance proceeds.

4. Communication with the Insurer

Maintain open communication with the insurance company throughout the claims process.

Respond promptly to any requests for additional information or clarification, and proactively address any potential issues that may arise.

Effective communication can help streamline the claims review process and facilitate a timely payout.

Final Thoughts

Knowing how much you can expect from your life insurance and what affects when you get it is important for both policyholders and beneficiaries.

While payouts usually take 1-2 months, staying ahead and knowing the ins and outs can make things easier.

For tailored advice on life insurance payouts and policies, reach out to us today for a complimentary quote.

Read More!