Survivorship life insurance policies offer a valuable tool for estate planning by ensuring financial stability.

This also makes one avoid the need to hastily sell assets at low prices to cover federal estate taxes after both spouses pass away.

These policies also offer potential tax advantages for the surviving spouse.

Typically, the beneficiaries of such policies include children, an Irrevocable Life Insurance Trust, or a Dynasty Trust.

Additionally, survivorship life insurance can assist in providing ongoing financial support for a disabled child and may offer enhanced coverage options for spouses dealing with medical conditions.

However, navigating business transition planning can be intricate, so it’s essential for partners to collaborate closely with legal or financial experts well-versed in this field

How the Survivorship Life Insurance Policies Becomes Helpful in Estate Planning

Survivorship life insurance policies play a vital role in estate planning by providing financial security and liquidity to cover estate taxes without the need to sell assets at low prices.

These policies ensure that your loved ones are well taken care of and can help maximize your estate’s value for future generations.

Additionally, they offer flexibility in providing ongoing support for dependents, such as children with disabilities, and can serve as a valuable tool in minimizing estate taxes.

When a couple, typically two spouses, applies for life insurance, they both undergo the application process together to obtain their policy.

However, unlike traditional life insurance that covers only one policyholder and pays out after their death, a survivorship policy doesn’t pay out until both individuals have passed away.

The surviving policyholder continues to pay the premiums until their death, at which point the beneficiaries receive the full death benefit.

This aspect of survivorship policies makes them less suitable if your aim is to provide financial support to your loved ones after one person’s death.

Typically, these policies are purchased to safeguard the financial well-being of future generations.

Since survivorship life insurance policies are permanent, they include a cash value component alongside the death benefit, serving as a tax-deferred savings option.

Unlike the death benefit, you can access the cash value of the policy while you’re still alive.

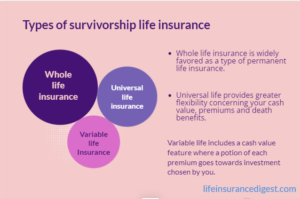

Types of survivorship life insurance

Whole life insurance

Whole life insurance is widely favored as a type of permanent life insurance.

These policies feature consistent premiums, an assured death benefit, and a cash value that accumulates with interest set by the insurer.

Universal life insurance

On the other hand, universal life insurance provides greater flexibility concerning your cash value, premiums, and death benefit.

With universal life policies, you can frequently utilize your cash value to cover your premiums.

In certain variations of universal life policies, the growth of the cash value is linked to a market index, which means you may assume more investment risk.

Variable Life Insurance Policy

Variable Survivorship Life Insurance offers flexibility and investment potential.

It includes a cash value feature where a portion of each premium goes towards investments chosen by you. You have control over your investments, but also bear the investment risks.

The insurer provides a range of investment options for you to choose from

Survivorship Life Insurance InfographPros and Cons of Survivorship Life Insurance

Pros

Providing lifelong support for dependents:

If you have a dependent who will always rely on your financial support, such as a child with disabilities.

A survivorship life insurance policy ensures that you leave behind funds to care for them throughout their life.

You can set up the policy to fund a special needs trust, ensuring your dependent receives income even if both parents are no longer present to support them.

Estate planning advantages:

If your goal is to leave assets to heirs or reduce estate taxes, survivorship life insurance can be a valuable tool. Its primary purpose is to maximize your estate’s value and provide liquidity.

It’s advisable to consult with an estate planning attorney to explore this option further.

Cost-effectiveness compared to two separate policies:

While purchasing individual permanent life insurance policies can be costly, a single survivorship policy can sometimes be more economical in the long run than buying two separate policies.

Coverage for partners with health conditions:

If one partner is unable to qualify for their own life insurance policy due to health reasons, a joint survivorship policy can provide coverage for both individuals under a single policy.

Access to cash value:

Although the death benefit is payable only after both policyholders have passed away.

Many permanent policies accumulate cash value over time, which can be accessed by the surviving spouse while the policy is still active.

This feature provides financial flexibility and potential supplemental income when needed.

Cons

Higher costs:

Survivorship life insurance can be pricier due to its permanent nature compared to other life insurance options.

Delayed payout:

The insurance company only pays out the death benefit after both insured individuals have passed away.

If your beneficiaries require immediate financial assistance, you might want to explore alternative policy types.

Complexity in division during divorce:

If you anticipate changes in your marital status, a survivorship policy could add complexity to divorce proceedings.