Wondering what happened to American General Life Insurance Company? Well, worry no more because this article will provide you with all the answers you need.

Formerly known as American General Life Insurance Company under AIG, now rebranded as Corebridge Financial in 2022, the company has a rich history.

Back in the early 2000s, AIG acquired American General Corporation, a top provider of domestic life insurance and annuities, expanding its reach into markets like India.

In response to market needs, AIG collaborated with the Blackstone Group and Kissinger Associates in February 2000 to offer strategic financial advisory services.

However, during the 2008 financial crisis, AIG faced a significant setback due to high debt and risky investments, prompting a substantial $85 billion loan from the Federal Reserve.

Additionally, American General Life and Accident Insurance Co. faced legal challenges, with a notable $35 million punitive damages verdict in Mobile County.

The History of American General Life Insurance Company

Founded in 1926, American General focused on providing affordable life insurance policies to middle-class families.

Their philosophy was that everyone should have access to quality insurance coverage, regardless of income level.

This approach helped them gain a loyal customer base and establish trust as a reliable provider of life insurance.

Initially, American General focused on delivering accessible life insurance solutions tailored to middle-class households, driven by a belief in universal insurance access.

This ethos fostered a loyal customer base, positioning the company as a dependable insurance provider.

As it evolved, the company diversified its offerings to encompass health and disability insurance, alongside strategic acquisitions, reinforcing its market presence.

By the 1990s, American General Life Insurance Company stood as a global insurance giant, operating across 50+ countries. Yet, this prosperity was short-lived. Towards the late 1990s, financial turbulence struck American General.

Risky investments resulted in substantial losses, compounded by critiques of its management prioritizing short-term gains over sustained growth.

Over time, they expanded their offerings to include health and disability insurance, and through acquisitions, they became one of the largest insurers globally by the 1990s.

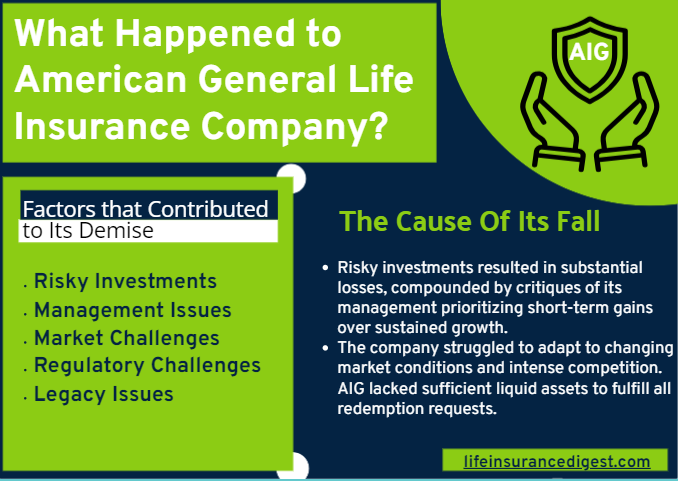

what-happened-to AIGFactors that Contributed to Its Demise

Several factors contributed to American General’s decline:

1. Risky Investments: In the late 1990s, the company made risky investments that resulted in significant losses.

The situation worsened for AIG as the values of the securities involved in the transactions declined alongside falling real estate prices and increased foreclosures.

2. Management Issues: Criticisms arose about the management team prioritizing short-term profits over long-term growth.

3. Market Challenges: The company struggled to adapt to changing market conditions and intense competition. AIG lacked sufficient liquid assets to fulfill all redemption requests.

Similar to a bank experiencing instability prompting rapid withdrawals, AIG’s weakened position caused more securities lending counterparties to reclaim their securities and demand cash, exacerbating AIG’s decline.

4. Regulatory Challenges: Regulatory changes posed additional hurdles.

5. Legacy Issues: Legacy issues from previous decisions weighed down the company.

Restructuring and Rebranding

To address these challenges, American General underwent a major restructuring in the early 2000s.

They sold non-core businesses, refocused on core insurance operations, and brought in new leadership.

Despite these efforts, the company continued to struggle.

Under AIG’s ownership, American General operated as a separate entity but lost its former influence in the insurance industry. In 2010, AIG rebranded it as AIG Life and Retirement.

American International Group (AIG), a global finance and insurance company, had announced its intention to spin off its life insurance and retirement businesses into a separate company as early as 2020.

In March 2023 , AIG revealed the new company’s name as Corebridge Financial.

Corebridge officially launched as a new entity and successfully completed its initial public offering in September, positioning itself as one of the leading providers of retirement and insurance products in the U.S.

Customers should expect no changes in the products offered, except for the shift in name from AIG to Corebridge.

While some documentation, both paper and online, including policies, may still mention AIG, references to American General Life Insurance Company.

The issuing life insurance companies in certain areas, might also appear.

Corebridge’s product offerings span four categories: individual retirement, group retirement, life insurance, and institutional markets.

The company is led by CEO Kevin Hogan, who embarked on his career with AIG in 1984.

Corebridge offers term, permanent, and final expense life insurance. Its IPO, which garnered $1.7 billion, marked the largest deal size of the year.

In summary, American General Life Insurance Company downfall resulted from a combination of factors, including risky investments, market dynamics, and management decisions. Its legacy serves as a cautionary tale for the insurance industry.

Final Thoughts

The American General Life Insurance Company once held a prominent position in the insurance realm but faltered due to a mix of factors, including risky investments and short-sighted leadership.

However, despite no longer operating under its original name, its commitment to delivering top-notch insurance coverage resonates with customers worldwide.

The tale of American General Life Insurance Company serves as a valuable lesson for companies across all sectors.

Despite experiencing initial success, the company faced challenges stemming from managerial decisions that ultimately led to its downfall.

Nevertheless, its dedication to offering accessible insurance to middle-class families remains steadfast as a fundamental aspect of its enduring legacy.

Though the name has changed, the core values of American General Life Insurance Company continue to shape AIG Life and Retirement today.

Read More!